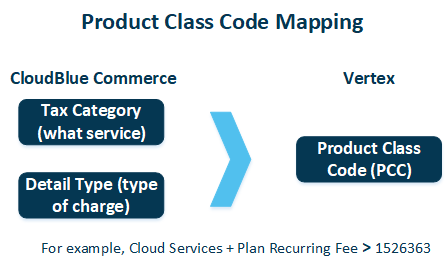

The products or services are differently subjected to taxation depending on the type of charging. For example, let's consider telecommunications. The tax on the installation and the tax on the monthly user charge are different. In CloudBlue Commerce, you should configure mapping of product codes for Vertex to be able to calculate taxes. Vertex has its own classification of product class codes which should be mapped to the respective type of service/resource and type of charging in CloudBlue Commerce (see the scheme below).

In CloudBlue Commerce, the order can contain several lines or details each representing a service plan/resource rate and the respective type of charge (setup fee, recurring fee and so on):

- One order can include multiple lines related to one resource (for example, resource setup fee and resource recurring fee).

- One order can also include multiple lines for a single service plan (for example, plan setup fee, plan recurring fee, resource setup fee, resource recurring fee).

- One order can also include lines related to multiple service plans (for example, several subscriptions are billed in a single billing order, several subscriptions are purchased together and so on).

The tax is calculated for each line and then summed up. CloudBlue Commerce integrated with Vertex will calculate taxes for each of the lines in the order independently. The order's total tax is calculated as a sum of all taxes applicable to all transactions in the order.

For Vertex to be able to identify the product in the passed transaction, CloudBlue Commerce sends the product code according to Vertex classification ("Product Class Code"). The mapping between CloudBlue Commerce entities that represent product/service to be sold and Vertex "Product Class Code" is configured and stored in CloudBlue Commerce.

Example

A customer buys a "VPS - S" subscription for one month and a tax rate = 10%. The order sample is represented below:

|

Description |

Type |

Quantity |

Duration |

Unit Price |

Discount |

Extended Price |

Detail Start Date |

Detail End Date |

|---|---|---|---|---|---|---|---|---|

|

Linux VPS – S Recurring |

Plan Recurring |

1.00 item |

1 month(s) |

$ 18.99 |

$ 0.00 |

$ 18.99 |

10-Oct-2017 |

09-Nov-2017 |

|

Plesk for Web Professionals Recurring |

Resource Recurring |

1.00 unit |

1 month(s) |

$ 10.00 |

$ 0.00 |

$ 10.00 |

10-Oct-2017 |

09-Nov-2017 |

Total tax = tax for line 1 + tax for line 2 ~ $1.9 + $1 = $2.9

The first order line has the specified service (Linux VPS – S Recurring) and the type of charge/detail type (Plan Recurring). The service plan belongs to the particular plan category. Each plan category belongs to the particular tax category. Thus, Billing matches each pair of tax category and detail type with "Product Class Code". The result of this mapping is sent to Vertex which is able to recognize what service and charge type is used in the transaction due to the passed "Product Class Code".

The second order line has the specified resource (Plesk for Web Professionals Recurring) and the type of charge/detail type (Resource Recurring). The resource belongs to the particular resource category. Each resource category belongs to the particular tax category. Thus, Billing matches each pair of tax category and detail type with "Product Class Code". The result of this mapping is sent to Vertex which is able to recognize what resource and charge type is used in the transaction due to the passed "Product Class Code".