Depending on whether you use own merchant account or operate through provider's account, the services resale scheme is different. The following parameters define your resulting balance:

- (+) Current balance is the sum of all your open payments.

- (-) Not Invoiced purchases is the total by all services you have purchased from provider (at wholesale price).

- (+) Payments processed through provider is the total by all payments processed through provider's merchant account. Provider may charge every transaction for a financial charge.

-

(+) Available credit limit defines the credit you are given for sales on trust. Depending on provider services provisioning terms, it may be zero to positive.

Note: A credit limit is used as is for VAR resellers. For customers and resellers acting as customers, please refer to Notes on Credit Limit.

- Available Balance is the sum of all four parameters. "+" or "-" before the parameter name define whether the parameter value is added or subtracted from the available balance.

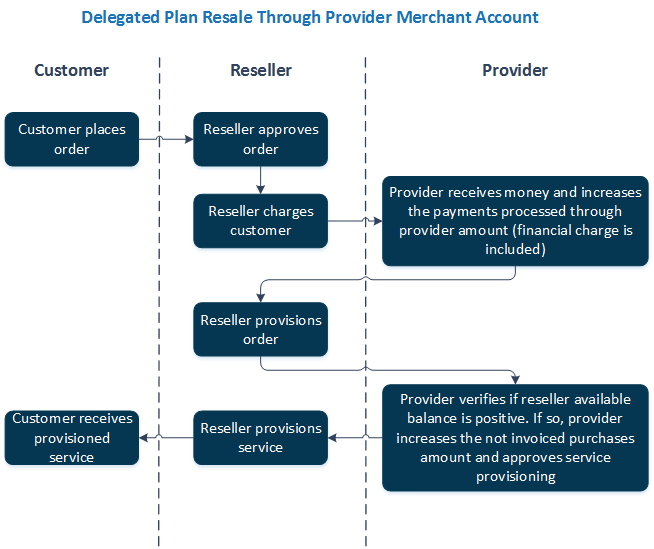

- Customer places order.

- Reseller approves order.

- Customer pays through provider's merchant account.

- Provider receives money and increases the payments processed through provider amount (financial charge is included).

- Reseller approves subscription provisioning.

- Provider verifies if reseller available balance is positive. If so, provider starts services provisioning and increases the not invoiced purchases amount.

- Reseller provisions services.

- Customer receives provisioned services.

In correspondence with reseller subscription service provisioning terms, provider creates credit memo for the sum calculated as follows:

Credit Memo= (Payments processed through provider) - [(Not Invoiced Purchases) + (Payments processed through provider) * (Financial Charge)].

Billing order is issued for a reseller on billing date. The order sum includes the not-invoiced purchases amount and reseller recurring fee. The credit memo is applied to the billing order. The remaining credit memo balance increases reseller account balance. This facilitates settlements between provider and reseller since credit memo balance always demonstrates the amount provider owes to reseller.

Note: The billing order is created in the Open status. This means that immediately after creation, Billing will try to pay this order with the reseller default payment method. To be able to apply the credit memo to the billing order, it is necessary to disable auto-payment for the reseller default payment method.

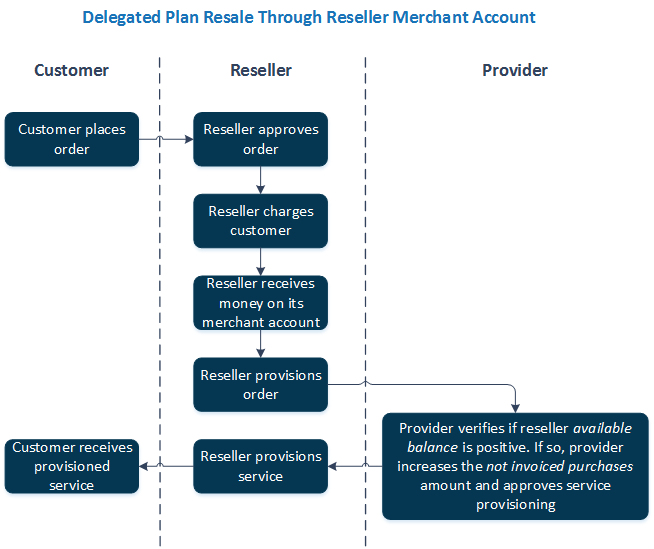

Starting condition: A reseller tops up their balance or has a credit limit.

- Customer places order.

- Reseller approves the order.

- Reseller charges customer.

- Reseller receives money.

- Reseller requests services from provider.

- Provider verifies if reseller available balance is positive. If so, provider starts services provisioning and increases the not invoiced purchases amount.

- Reseller provisions services.

- Customer receives provisioned services.

On the billing date reseller is invoiced for the not invoiced purchases amount and reseller recurring fee.