In this section, we will consider service resale schemes for delegated and non-delegated service plans.

Resale of Delegated Service Plans

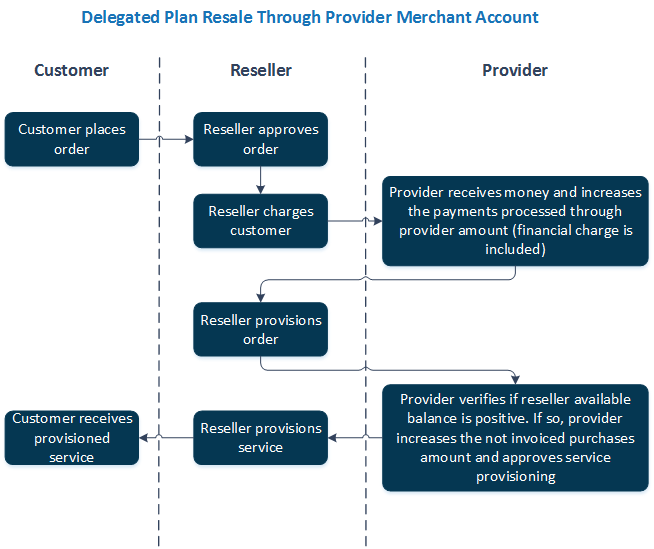

Depending on whether a reseller uses its own merchant account or operates through the provider's account, the services resale scheme is different. The following parameters define the reseller's resulting balance:

- (+) Current balance is the sum of all open payments of the reseller.

- (–) Not Invoiced purchases is the total of all services a reseller has purchased from the provider (at wholesale price).

- (+) Payments processed through the provider is the total of all payments processed through the provider's merchant account. The provider may charge every transaction using a financial charge.

-

(+) Available credit limit defines the credit a reseller is given for sales on trust. Depending on the provider's service provisioning terms, it may be from zero to positive.

Note: A credit limit is used as is for VAR resellers. For customers and resellers acting as customers, please refer to Notes on Credit Limit.

- Available balance is the sum of all four parameters. A "+" or "–" before a parameter name defines whether the parameter value is added or subtracted from the available balance.

- A customer places an order.

- A reseller approves the order.

- A customer pays through the provider's merchant account.

- A provider receives money and increases the payments processed through provider amount (financial charge is included).

- A reseller approves the subscription provisioning.

- A provider verifies if the reseller's balance is positive. If so, the provider starts service provisioning and increases the not invoiced purchases amount.

- A reseller provisions the services.

- A customer receives the provisioned services.

In correspondence with the service provisioning terms of the reseller's subscription, the provider creates a credit memo for the sum calculated as follows:

Credit Memo = (Payments processed through Provider) - [(Not Invoiced Purchases) + (Payments processed through Provider) * (Financial Charge)].

A billing order is issued for a reseller on a billing date. The order sum includes the amount of not-invoiced purchases and reseller recurring fee. The credit memo is applied to the billing order. The remaining credit memo balance increases the reseller's account balance. This facilitates settlements between the provider and a reseller, because credit memo balance always demonstrates the amount the provider owes to a reseller.

Note: The billing order is created in Open status. This means that immediately after creation, CloudBlue Commerce will try to pay this order using a reseller's default payment method. To be able to apply the credit memo to the billing order, you need to disable auto-payment for the reseller's payment method.

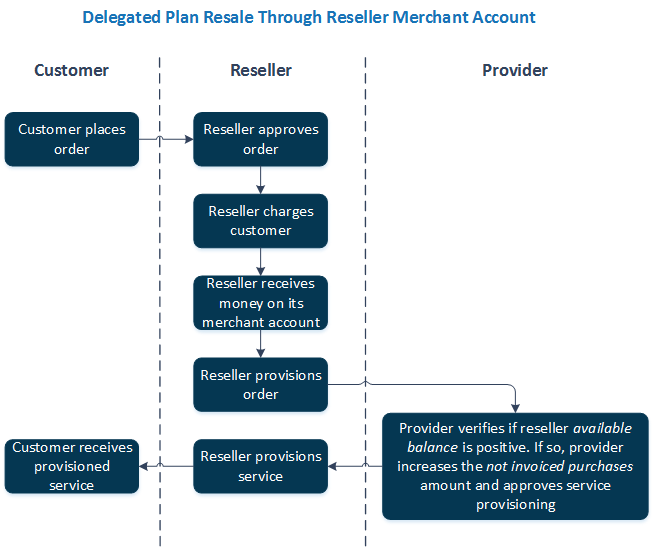

Stating condition: a reseller tops up their balance or uses a credit limit.

- A customer places an order.

- A reseller approves the order.

- A reseller charges the customer.

- A reseller receives money.

- A reseller requests services from the provider.

- A provider verifies if the reseller's available balance is positive. If so, the provider starts service provisioning and increases the not invoiced purchases amount.

- A reseller provisions the services.

- A customer receives the provisioned services.

On the billing date, the reseller is invoiced for the amount of not invoiced purchases and reseller recurring fee.

Resale of Non-Delegated Service Plans

- The sales of non-delegated service plans through a reseller merchant account are not related to the provider and do not affect the reseller's balance.

- The sales of non-delegated service plans through a provider merchant account are similar to the sales of delegated service plans. The difference is that when a provider credits a reseller, instead of the margin between wholesale price and retail price, the reseller gets the retail price they set (minus any financial charges).